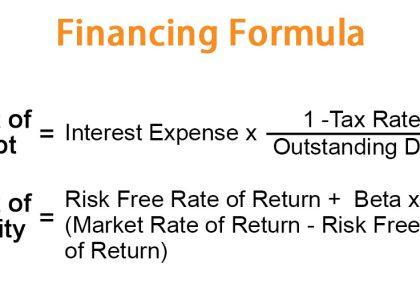

This means that purchases can now be made with much less upfront dedication, resulting in higher customer experience and elevated trust in your company. This approach ends in a win-win scenario for each you and the consumer because you get paid instantly while the shopper can settle the payments over time. It is utilized primarily for on-line buying, and it’s now available for a selection of merchandise offered on eCommerce.

Up to 48 months 29.9% APR representative curiosity possibility finance. Retailer Name as seems on FCA register buying and selling as Trading Name is a credit score broker and is Authorised and Regulated by the Financial Conduct Authority. If you compromise earlier than 48 months you’ll solely pay the interest accrued over the number of months you may have been paying the loan.

Think First Before You Purchase Now, Pay Later

Example below if you Choose Buy now pay later and pay within the first 12 months. We can give you a choice of two fantastic Finance choices. We’ve partnered with Klarna to give you a better purchasing expertise.

Klarna is currently obtainable in 17 nations, together with the United States, the United Kingdom, Sweden, and Germany. Customers are provided probably the most acceptable cost options, corresponding to paying in 4 interest-free installments spread over six to eight weeks or finishing month-to-month payments for as much as two years. Once the settlement has been signed, your month-to-month repayments will begin once your deferral period ends.

How To Repay ‘Buy Now, Pay Later’ Money Owed With Klarna, Clearpay And Laybuy

For Pay by Finance, the one attainable further payment can be should you fall into arrears. In that occasion, Novuna Finance will cost you for each arrears letter sent out. This won’t affect you should you pay your mounted month-to-month payments on time. Whereas if you’re deciding on Zip for short-term finance, you don’t have to pay any deposit. You as a substitute pay the first instalment upfront, which is 25% of your full purchase amount.

In Nigeria, buy now pay later BNPL credit startups take off – Rest of World

In Nigeria, buy now pay later BNPL credit startups take off.

Posted: Fri, 24 Jun 2022 07:00:00 GMT [source]

Online consumers have come to count on to purchase now and pay later wherever they store. The addition of purchase now, pay later services to the market is an answer that has proven its worth within the eCommerce sector. It has turn into an essential, anticipated facet of the shopping for experience. This is very true in your increasing Millennial customer base. Interest bearing finance, repayments will start one month after you sign.

In most cases you could also select to spread the value of the tumble dryer by paying a small amount each week or month. This is very handy if you find it difficult to save lots of up as you can simply set up a direct debit. As these are finance deals you will be credit checked so if you realize you are credit score rating isn’t great you may wish to undergo a bad credit catalogue to improve your possibilities of getting accredited.

You will then be directed to Zip’s fast and simple checkout. Buying home equipment on finance at Herne Bay Domestics is easy. First, click on the “Buy Now” button on the equipment you wish to buy. This will take you through to your basket page where you’ll be able to evaluate your order. Once you may be pleased with your basket, click on the “Proceed to checkout” button and fill out your billing particulars. Based on your solutions it looks as though you’re doing every thing you can to maintain on high of your repayments, however you may be ready to make enhancements.

Follow 3 simple steps to arrange our Buy Now Pay Later interest free choice. MINTEL CONSULTING Mintel Consulting delivers a contemporary viewpoint supported by rigorous knowledge on brand, innovation, strategy and client perception. In order to safeguard against fraudulent applications, we remorse that we’re in a position only to ship items to the home address of the applicant, and contained in the property.

They will have the flexibility to explain the credit choices we offer and will take info from you in order to full a credit score utility. You will be suggested there and then whether or not your utility has been profitable. Homemakers aren’t excluded from applying under their very own names; however, the employment details of your spouse/partner might be required in order to course of your utility. If you don’t pay the complete balance following the initial 12 month payment free interval then interest will be charged which can embody curiosity accrued from the beginning of the agreement. Within minutes of your utility being accepted and accredited, you could be given the selection to signal your credit score contract.