When it comes to purchasing a new phone, many individuals with poor credit may feel limited in their options. However, there are contract phones available that offer monthly payment plans specifically designed for those with less-than-perfect credit scores. These plans allow customers to pay for their phone over time, making it more accessible to a wider range of individuals. By demystifying the process of contract phones and exploring the monthly payment options available, those with poor credit can still enjoy the latest technology without breaking the bank.

One key benefit of contract phones with monthly payment options is the ability to improve one’s credit score. By making regular on-time payments, individuals can demonstrate financial responsibility and potentially increase their credit worthiness over time. Additionally, these plans often come with affordable monthly payments, making it easier for individuals with poor credit to budget for their phone expenses. In the next section, we will discuss the key takeaways of contract phones with monthly payment options, including the application process, payment terms, and potential benefits for those with poor credit.

What you should know

1. Contract phones are available for individuals with poor credit through monthly payment plans, allowing them to obtain a phone without a large upfront cost.

2. Some companies offer no credit check options for contract phones, making it easier for those with poor credit to qualify for a plan.

3. It is important for individuals with poor credit to carefully review the terms and conditions of the contract phone plan, including the monthly payment amount, length of the contract, and any additional fees.

4. By making timely monthly payments on their contract phone plan, individuals with poor credit can improve their credit score over time.

5. Contract phones can be a viable option for individuals with poor credit who are in need of a reliable phone for communication and daily tasks.

What are the Monthly Payment Options for Those with Poor Credit when it comes to Contract Phones?

For individuals with poor credit looking to get a contract phone, there are several monthly payment options available to help make this possible. One option is to opt for a SIM-only contract, which does not require a credit check. With a SIM-only contract, you pay a monthly fee for a set amount of data, minutes, and texts without the need for a credit check. This can be a great option for those with poor credit who still want the benefits of a contract phone.

Pay-As-You-Go Plans

Another option for those with poor credit is to consider pay-as-you-go plans. With pay-as-you-go plans, you only pay for the minutes, texts, and data that you use, making it a flexible and budget-friendly option for individuals with poor credit. These plans do not require a credit check, making them accessible to a wider range of consumers.

Pay-as-you-go plans also allow you to top up your phone as needed, giving you control over how much you spend each month. This can be especially beneficial for those on a tight budget or who may have fluctuating income levels. Additionally, pay-as-you-go plans often do not require a long-term commitment, giving you the freedom to switch plans or providers as needed.

Prepaid Plans

Prepaid plans are another option for individuals with poor credit who are looking for a contract phone. With a prepaid plan, you pay for your minutes, texts, and data upfront, eliminating the need for a credit check. Prepaid plans are often more affordable than traditional contract plans, making them a popular choice for those with poor credit.

Prepaid plans also offer flexibility and control over your spending, as you can choose how much to top up your phone each month. This can help you stay within your budget and avoid unexpected charges. Additionally, prepaid plans typically do not require a long-term commitment, giving you the freedom to switch plans or providers as needed.

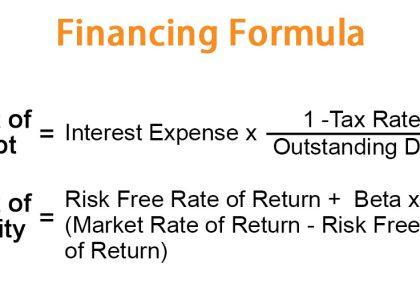

Alternative Financing Options

For those with poor credit who are interested in getting a contract phone, there are alternative financing options available. Some providers offer financing plans specifically designed for individuals with poor credit, allowing them to pay for their phone in installments over time. While these financing plans may come with higher interest rates or fees, they can be a viable option for those who may not qualify for traditional contract plans. If you’re in the UK and looking for contract phones with monthly payments despite bad credit, you can explore more options at ajop.org/contract-phones-pay-monthly-with-bad-credit-in-uk.

It’s important to research and compare different financing options to find the best fit for your needs and budget. Additionally, be sure to read the terms and conditions carefully to understand any potential fees or penalties associated with the financing plan. By exploring alternative financing options, individuals with poor credit can still enjoy the benefits of a contract phone.

1. Can I get a contract phone if I have poor credit?

Yes, you can still get a contract phone even if you have poor credit. Many phone providers offer monthly payment options specifically designed for those with poor credit. These options may include higher upfront costs or stricter terms, but they can still provide you with access to a new phone and a reliable service plan.

2. What are the benefits of choosing a contract phone with poor credit?

Choosing a contract phone with poor credit can have several benefits. First, it can help you rebuild your credit by making consistent monthly payments. Second, it can provide you with access to a new phone and service plan that you may not be able to afford upfront. Finally, it can give you peace of mind knowing that you have a reliable phone and service plan, even if your credit is less than perfect.

3. Are there any downsides to getting a contract phone with poor credit?

While there are benefits to getting a contract phone with poor credit, there are also some downsides to consider. For example, you may have to pay higher upfront costs or agree to stricter terms than someone with good credit. Additionally, you may be limited in the types of phones and service plans available to you. It’s important to weigh these factors carefully before deciding if a contract phone is the right choice for you.

4. How can I improve my chances of getting approved for a contract phone with poor credit?

Improving your chances of getting approved for a contract phone with poor credit can be done by taking steps to improve your credit score. This may include paying off outstanding debts, making on-time payments, and reducing your overall debt-to-income ratio. Additionally, you can consider applying for a contract phone with a provider that specializes in serving customers with poor credit, as they may have more lenient approval criteria.

5. What happens if I miss a payment on my contract phone with poor credit?

If you miss a payment on your contract phone with poor credit, you may incur late fees or penalties. Additionally, your service may be temporarily suspended until you make the payment. It’s important to communicate with your provider if you are having trouble making payments, as they may be able to work out a payment plan or alternative arrangement to help you stay current on your contract.

6. Can I upgrade my phone or service plan with poor credit?

Depending on the terms of your contract, you may be able to upgrade your phone or service plan with poor credit. However, you may be required to pay additional fees or meet certain criteria in order to qualify for an upgrade. It’s important to review the terms of your contract carefully and communicate with your provider if you are interested in upgrading your phone or service plan.

7. Will getting a contract phone with poor credit affect my credit score?

Getting a contract phone with poor credit may not directly affect your credit score, as long as you make on-time payments and fulfill the terms of your contract. However, if you miss payments or default on your contract, it could have a negative impact on your credit score. It’s important to make payments on time and communicate with your provider if you are having trouble meeting your obligations.

8. Can I cancel my contract phone with poor credit?

Depending on the terms of your contract, you may be able to cancel your contract phone with poor credit. However, you may be required to pay an early termination fee or fulfill certain conditions in order to cancel your contract. It’s important to review the terms of your contract carefully and communicate with your provider if you are considering canceling your contract.

9. Are there any alternatives to getting a contract phone with poor credit?

If you have poor credit and are unable to get a contract phone, there are alternatives available to you. For example, you can consider purchasing a prepaid phone or using a pay-as-you-go service plan. These options do not require a credit check and can provide you with a more flexible and affordable alternative to a traditional contract phone.

10. How can I find the best contract phone options for those with poor credit?

To find the best contract phone options for those with poor credit, it’s important to research different providers and compare their offerings. Look for providers that specialize in serving customers with poor credit and offer flexible payment options. Additionally, read reviews and ask for recommendations from friends or family members who may have experience with contract phones for those with poor credit. By doing your research and comparing your options, you can find a contract phone that meets your needs and fits your budget, even with poor credit.