Insider Trading Laws, Charges & Statute of Limitations are crucial elements in the realm of finance that aim to preserve fairness and transparency in the marketplace. Insider trading refers to the illegal practice of trading stocks or other securities based on non-public information that provides an unfair advantage to the trader. This violation shakes the foundation of trust and fairness in the financial system, potentially harming innocent investors and affecting overall market integrity.

When it comes to insider trading, the consequences can be severe. Prosecution for insider trading violations can result in criminal charges, civil penalties, and significant fines. Not only does this illegal practice undermine the trust that investors place in the financial system, but it also distorts the level playing field for all market participants. These laws and charges exist to ensure that no individual or entity gains an unfair advantage at the expense of others.

Now, let’s delve into the key takeaways relating to insider trading laws, charges, and the statute of limitations. Understanding the various aspects of insider trading, such as its legal implications, the types of individuals who may be held liable, and the timeframe in which charges can be brought, is essential for both investors and professionals in the financial sector. In the following sections, we will explore these intricacies and shed light on the measures put in place to safeguard the integrity of the financial markets.

1. Insider trading refers to the buying or selling of securities based on material, non-public information, which is illegal under U.S. federal law, with severe penalties for violators.

2. Insider trading charges can be brought against both the individuals who trade on inside information and the insiders who disclose the information.

3. Statute of limitations for bringing insider trading charges is generally five years, but can be extended in certain circumstances, such as when the government is investigating a larger scheme or conspiracy.

4. The Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) are the primary regulatory bodies responsible for investigating and prosecuting insider trading violations.

5. Recent legal developments have focused on expanding the definition of insiders, cracking down on tippees who trade on confidential information, and enforcing regular training programs for companies to promote awareness and compliance.

What are the Insider Trading Laws, Charges & Statute of Limitations?

Overview of Insider Trading Laws

Insider trading refers to the buying or selling of stocks or other securities based on material, non-public information. It is illegal and undermines the fairness and integrity of the financial markets. Insider trading laws are in place to prevent individuals from exploiting confidential information for personal gain. These laws aim to maintain a level playing field for all investors and promote trust in the financial system.

Elements of Insider Trading

To establish insider trading, certain elements need to be proven. Firstly, there must be a fiduciary duty or a relationship of trust and confidence between the person trading and the source of the information. Secondly, the individual must have received material non-public information. Finally, the person traded or tipped someone else using that confidential information.

Types of Insider Trading Charges

Insider trading charges can be classified into two main categories: classical and misappropriation insider trading. Classical insider trading involves a breach of fiduciary duty by corporate insiders, such as officers, directors, or employees who trade securities based on material non-public information. Misappropriation insider trading, on the other hand, occurs when individuals trade securities based on confidential information obtained from a source outside their fiduciary relationship.

Penalties for Insider Trading

The penalties for insider trading can be severe and vary depending on jurisdiction. Individuals found guilty of insider trading may face criminal charges that could lead to imprisonment, substantial fines, or both. In addition to criminal penalties, civil lawsuits may also be initiated by affected parties seeking financial compensation for their losses resulting from insider trading activities.

Statute of Limitations for Insider Trading

The statute of limitations determines the time period within which legal action can be taken. In the context of insider trading, the statute of limitations sets a deadline for initiating criminal or civil proceedings against individuals suspected of engaging in illegal trading activities. The length of the statute of limitations varies between jurisdictions, and it is crucial to consult local laws to ensure compliance.

Factors Affecting the Statute of Limitations

Several factors can affect the statute of limitations for insider trading cases. These factors may include the jurisdiction where the offense occurred, the nature and severity of the alleged violation, and any extensions granted by the court. It is essential to consult legal counsel and stay informed about the specific laws and regulations governing the statute of limitations in a particular jurisdiction.

Guides for Navigating Insider Trading Laws and Charges

- Stay Informed: Educate yourself about insider trading laws, staying updated on any changes or new regulations.

- Comply with Fiduciary Duties: If you are in a position that involves access to material non-public information, be aware of your fiduciary duties and act in the best interests of stakeholders.

- Avoid Trading on Non-Public Information: Refrain from trading stocks or securities based on confidential information that has not been made available to the public.

- Report Suspicious Activities: If you suspect insider trading, report it to the relevant regulatory authorities or compliance departments.

- Seek Legal Counsel: If you are facing insider trading charges or have concerns about potential violations, consult with an experienced attorney who specializes in securities law to protect your rights and navigate the legal process effectively.

Frequently Asked Questions

1. What is insider trading?

Insider trading refers to the illegal act of trading stocks or securities based on non-public information that could affect the stock’s price significantly. It involves buying or selling securities using information not available to the general public.

2. Are there specific laws that govern insider trading?

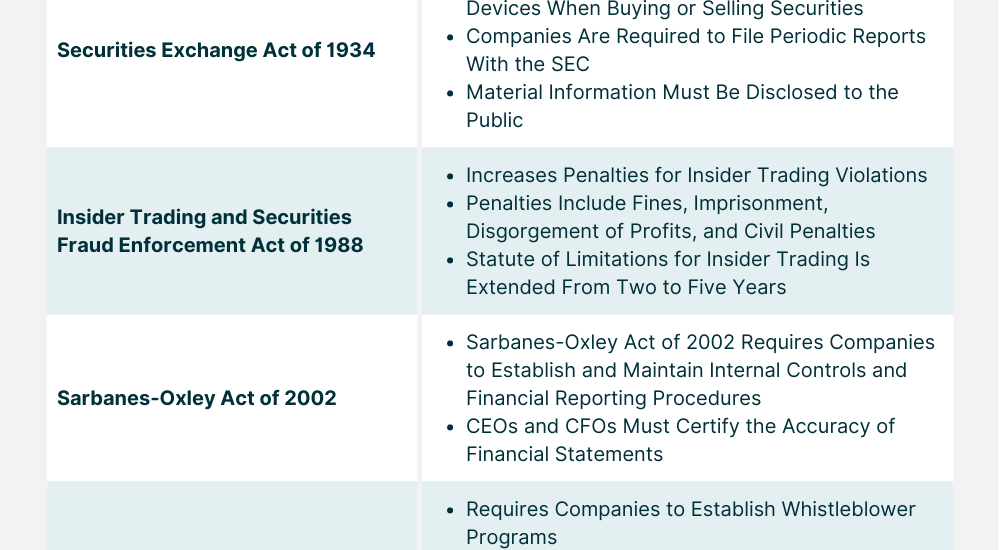

Yes, there are specific laws that govern insider trading, such as the Securities Exchange Act of 1934 in the United States. These laws aim to prevent unfair practices and protect investors by ensuring transparency and equal access to information.

3. What constitutes illegal insider trading?

Illegal insider trading occurs when a person trades stocks or securities using material non-public information obtained from an insider, such as a corporate executive or an employee. It is considered illegal because it undermines the fairness of the market and disadvantages other investors.

4. What are the penalties for insider trading?

The penalties for insider trading can vary depending on the jurisdiction and the severity of the offense. They can include fines, imprisonment, disgorgement of ill-gotten gains, and civil liability. In some cases, individuals may also face reputational damage and career consequences.

5. How is insider trading detected?

Insider trading can be detected through various methods, including market surveillance, analysis of trading patterns, and investigation of suspicious activities. Regulatory bodies, such as the Securities and Exchange Commission (SEC), employ sophisticated techniques to identify potential cases of insider trading.

6. What is the statute of limitations for insider trading?

The statute of limitations for insider trading refers to the timeframe within which legal action can be initiated against the alleged perpetrator. In the United States, the statute of limitations is generally five years from the date of the offense, although there are exceptions depending on the circumstances.

7. Can corporations be held liable for insider trading?

Yes, corporations can be held liable for insider trading if it is proven that the company or its executives were involved in the illegal activity. Corporations may face fines, regulatory sanctions, and reputational damage. Additionally, they may be required to implement measures to prevent future occurrences.

8. Can insider trading occur in other markets besides stocks?

Insider trading can occur in various markets, not limited to stocks. It can also involve other securities such as options, bonds, or commodities. The underlying principle remains the same – trading based on non-public information that gives the trader an unfair advantage.

9. How does insider trading impact market integrity?

Insider trading undermines market integrity by eroding investor confidence and creating an uneven playing field. It discourages fair and transparent trading, as well as compromises the trust that investors place in the market. Regulating insider trading is crucial to maintain the integrity and fairness of the financial markets.

10. Is there a difference between insider trading and insider buying/selling?

Yes, there is a difference between insider trading and insider buying/selling. Insider buying/selling refers to legal transactions where corporate insiders, such as executives or directors, buy or sell securities of their own company. Insider trading, on the other hand, involves illegal trading based on non-public information. The key distinction lies in the legality and fairness of the information used.

Final Thoughts

Insider trading laws, charges, and the statute of limitations play a crucial role in maintaining the fairness and transparency of financial markets. By prohibiting the use of non-public information for personal gain, these laws help protect the interests of all investors and prevent potential market manipulation. However, it is an ongoing challenge to detect and prosecute insider trading due to its clandestine nature. Vigilant surveillance, strict enforcement, and public awareness are vital in combating this illegal practice and upholding the integrity of our financial systems.

If you have any further questions about insider trading laws, charges, or the statute of limitations, consult legal professionals or regulatory authorities to ensure you have accurate and up-to-date information.